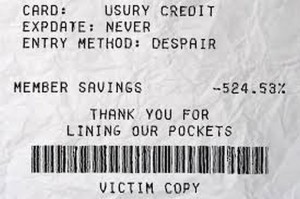

Jerusalem, January 20 – In a nod to advancing technology and and a proliferation of private banking activity, the Bank of Israel will assist emerging lenders by providing a welcoming online environment on their website to any Israeli individual or institution who seeks to fleece others by lending at high interest.

Jerusalem, January 20 – In a nod to advancing technology and and a proliferation of private banking activity, the Bank of Israel will assist emerging lenders by providing a welcoming online environment on their website to any Israeli individual or institution who seeks to fleece others by lending at high interest.

The service, called Net Profit, allows those who lend money at high interest to access some of its own internal analysis of the debt market, giving them a clearer picture in real time of borrowers to exploit and the profit potential in each demographic. The resource also offers a weekly analysis of which usurious practices are the most profitable. The bank, which sets the base rate for determining how much borrowers will pay for mortgages and other loans, introduced Net Profit as part of the Likud-led government’s tendency toward privatization and deregulation of commercial and financial activities.

Bank of Israel Commissioner Karnit Flug announced the new initiative this morning at the bank’s headquarters in Jerusalem, where representatives of several mid-size lenders and dozens of up-and-coming usurers had gathered to mark the occasion. Flug walked the attendees through the basic layout of the site, pointing out the prominence and clarity of the data, which would only be made available in such a comprehensible format to the lenders themselves.

Lenders seeking access to the information may apply through the bank’s website; bank personnel will verify the identity and status of the applicant. If indeed the applicant is found to be a lender, the bank will provide access, provided the lender signs a nondisclosure agreement prohibiting the provision of any useful information to potential borrowers. Individuals or institutions that violate that provision will be barred from future use of the site and fined.

The Bank of Israel will still provide some of the same information to the public, including potential borrowers, but only in a complex, confusing format with arcane, specialized terminology. The goal, according to Flug, is to cement the private individual and small business’s dependence on lenders for both capital and the wherewithal to manage their finances. “The banking industry in Israel is a backbone of the economy. The best way to ensure its economic future is to broaden and deepen the ways in which lenders can liberate assets from the hands of, for example, people seeking a home loan, who obviously don’t deserve all that money if they don’t have it in the first place,” she explained.

Net Profit is simply the latest manifestation of a trend in banking all over the world, says Ribbit Ketzutza, an analyst with Chasem & Burnham, a Tel Aviv securities firm. “There’s no realistic way of maintaining stable financial institutions and economic elite unless it involves adding wealth at the expense of those who don’t have nearly as much,” she said. “With money comes power, and the well-off use that power to prevent others from taking away their money. The only way to keep the wealthy happy is to drain the non-wealthy dry, and this new service lends the wealthy a hand in doing so.”

“At interest, of course,” she added.